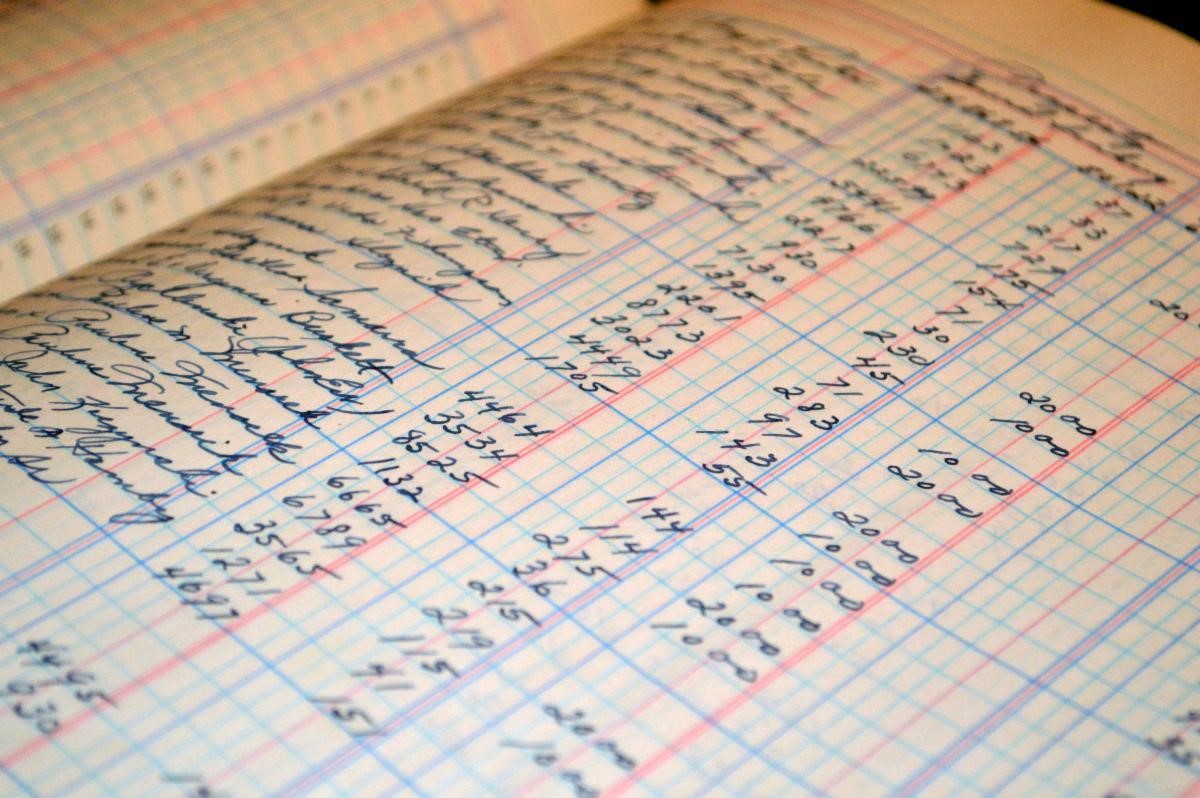

“Closing the Books” is one of those antiquated phrases I still use, like carbon copy and burning the midnight oil. When accountants used actual books, the process was manual and slow going. Today, we rely on innovative online tools to help us with the work. Still, the goal remains the same: Accuracy in the many layers of information found in the record of the company’s financial transactions.

Do not skip closings

Let’s jump to the most important takeaway—why you cannot and should not skip closing the books. There are both big picture and immediate consequence concerns.

Closing your books on a timely basis gives you consistent reporting and accurate reading on the health of the business. It is the only way to make informed business decisions.

The consequences of not closing on time are steep. Closing allows you to review the transactions that have been put into the system, see if they are accurate, and make adjustments where needed. When you don’t close, your financials are inaccurate for each period going forward. Your business needs financial accuracy to operate, full stop.

What happens during the monthly closing?

After you finish entering the day-to-day transactions in your journals, you are ready to close the books for the period. Most companies close their books monthly. During the process, the general ledger is reconciled, trial balance prepared, and financial statements created. This work ensures all account balances are correct for the beginning of the new accounting period.

After the closing

Once the books have been reconciled, it’s important to share them! The company’s accountant or controller should approve the books, and “lock” them. This means that no one can alter the data in the period that just closed. If errors are found in the future, a true-up entry can be applied to the month in which the error was discovered. Your management team should also review monthly financial reporting such as the income statement, balance sheet, and statement of cash flows, among others.

Accounting software may automate some of the steps noted above. However, unless your business is very small and has only a few transactions each month, you’ll likely want to have an accounting professional close your books for you. Do you need a recommendation or more insight? Reach out and ask!

Additional sources:

Learn the Basics of Closing Your Books

How to Close the Books: 8 Steps for Small Business Owners